Most Salt Lake City homeowners feel confident about their property. They know where the fence sits. They know where the driveway runs. And after living there for years, it feels settled. Then a property survey gets ordered.

Suddenly, everything changes.

This kind of story has been spreading online lately, and for good reason. Homeowners are discovering—often during a sale or refinance—that the land they thought they owned doesn’t match the legal records. The surprise doesn’t come from a neighbor digging up the yard. Instead, it shows up on paper, right when money, deadlines, and emotions are already involved.

And in Salt Lake City, this happens more often than people expect.

The Moment Everything Feels “Off”

Picture this. A homeowner decides to sell. The house looks great. The price is set. The buyer is ready. During the process, a property survey is ordered to satisfy title or lender requirements.

Then the results come back.

The boundary line shifts. Maybe it cuts into what the owner believed was their side yard. Maybe a structure sits closer to the line than expected. In some cases, the legal lot size ends up smaller than assumed.

Nothing physically moved. Yet ownership suddenly feels uncertain.

That shock is what makes these stories go viral. People relate because they see themselves in it. After all, no one expects a legal boundary issue to appear after years of quiet ownership.

Why a Property Survey Can Feel Like Bad News

A property survey doesn’t create problems. It reveals them. However, when homeowners encounter one late in the process, it feels like bad news arrived out of nowhere.

That feeling comes from assumptions. Many people believe long-term use equals ownership. Others rely on old paperwork, online maps, or what the previous owner said. Those sources feel trustworthy, so no one questions them—until a formal survey enters the picture.

Once that happens, the legal boundary matters more than memories or habits. That reality can feel uncomfortable, especially when a sale or loan depends on it.

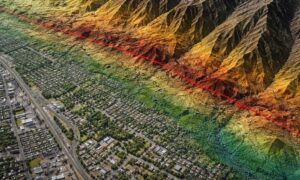

Why Salt Lake City Homes Face This Issue More Often

Salt Lake City has a unique mix of properties. Some neighborhoods date back decades, while others have seen rapid infill and redevelopment. Because of that, records don’t always line up neatly with how land has been used over time.

In addition, lot splits, additions, and accessory dwelling units have become more common. Each change adds scrutiny. When lenders, buyers, or title companies review a property, they look closely at boundaries.

That’s when a property survey becomes essential—and revealing.

For homeowners who never needed one before, the timing feels unfair. Still, the issue didn’t start during the transaction. It simply surfaced then.

When Property Surveys Enter the Process

Most homeowners don’t order a survey on their own. Instead, a property survey often appears during:

- A home sale

- Buyer due diligence

- Loan underwriting

- Refinancing

- Estate transfers

At that point, third parties need certainty. They want to know exactly what is being sold, financed, or insured. As a result, boundaries get verified.

When discrepancies show up, they don’t pause the process quietly. They affect timelines, negotiations, and sometimes pricing.

How a Property Survey Can Change a Deal

Once a property survey reveals a boundary difference, several things can happen.

First, the title company may add exceptions. Next, lenders may ask for clarification. Sometimes, legal descriptions need correction. In more complex cases, boundary agreements or revised exhibits become necessary.

Each step adds time and stress. Meanwhile, buyers may hesitate. Sellers may feel defensive. Everyone wants answers fast.

That pressure explains why these stories spread online. People aren’t just upset about land lines. They’re reacting to uncertainty during a high-stakes moment.

The Emotional Side Most People Don’t Expect

Homeownership feels personal. So when a property survey challenges what someone believed about their land, it hits hard.

Many homeowners think, “I’ve lived here for years. How could this be wrong?” Others worry about losing value or control. Even when the change is small, the emotional reaction can be big.

That response is normal. Still, it helps to understand that the survey didn’t take anything away. It clarified what the records already showed.

Once people accept that, they can focus on solutions instead of stress.

Why Surveys Don’t “Change” Property Lines

One common misunderstanding fuels frustration. Homeowners often say a survey changed their property line.

In reality, a property survey doesn’t move boundaries. It identifies them. The legal line existed long before the survey took place.

The problem lies in assumptions made over time. Without verification, those assumptions feel solid. However, when documentation matters, facts replace habits.

Understanding this difference helps homeowners move forward calmly, even when results surprise them.

How to Avoid Being Caught Off Guard

No one enjoys surprises during a sale or refinance. Fortunately, homeowners can reduce risk with better timing.

Ordering a property survey earlier—before listing or major financial decisions—gives owners control. They can address issues on their terms instead of under pressure.

Early awareness allows time for corrections, discussions, or planning. More importantly, it prevents last-minute chaos when deadlines loom.

In growing cities like Salt Lake City, proactive steps make a real difference.

Why These Stories Matter Right Now

The viral nature of these stories shows a pattern. As markets stay active and scrutiny increases, more homeowners encounter surveys they never expected.

That doesn’t mean surveys are becoming harsher. It means transactions demand clarity.

A property survey provides that clarity. While the truth can feel uncomfortable at first, it ultimately protects everyone involved.

Final Thoughts

Salt Lake City homeowners don’t expect paperwork to challenge their sense of ownership. Yet when a property survey enters the picture, assumptions meet reality.

These stories matter because they remind people that certainty matters most when money and decisions are on the line. Knowing boundaries early brings confidence, smoother transactions, and fewer surprises.

In the end, a property survey isn’t a setback. It’s a safeguard—especially when it matters most.