After the powerful October 2025 storms, many homeowners were shocked to see water pooling in driveways, backyards, and even window wells. Streets that had always looked dry suddenly turned into mini rivers. Now, more residents are being told by lenders, insurers, or city officials that they need a flood elevation certificate something most people had never heard of before.

But what is it? Why is everyone suddenly talking about it? And how does it protect your property the next time heavy rain hits Utah?

A Wake-Up Call for “Dry” Neighborhoods

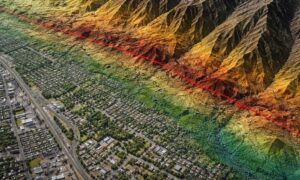

The 2025 storms didn’t just flood low-lying areas near the Jordan River. Even homes that sat “high and dry” for years saw unexpected water damage. According to a recent Axios report, nearly 5% of homes in the Salt Lake metro area—worth almost $9 billion—are now rated at severe or extreme flood risk.

That number stunned a lot of Utahns. For homeowners, it hit especially close to home. Neighborhoods around Daybreak, the Jordan River Parkway, and Oquirrh Lake experienced unexpected ponding and runoff that local drainage systems couldn’t handle.

While the rain has stopped, the concern hasn’t. The floods revealed what FEMA and local officials have been warning about for years: our maps and reality don’t always match.

What Exactly Is a Flood Elevation Certificate?

A flood elevation certificate is a survey document that shows how high your home sits compared to the Base Flood Elevation (BFE) set by FEMA. In other words, it proves whether your house is safely above—or worryingly below—the level water could reach during a 100-year flood event.

A licensed land surveyor measures your property’s lowest floor, foundation openings, and the surrounding ground. Those precise measurements are then compared to official flood maps and recorded benchmarks.

Why does this matter? Because your flood risk rating—and your insurance cost—depend on it. If your home is higher than FEMA’s predicted flood line, you might lower your insurance premium or even remove the flood zone designation entirely. If it’s lower, you’ll know what steps to take to protect your property.

Outdated Maps vs. Real-World Risks

Many homeowners still rely on FEMA flood maps drawn years ago, sometimes before the city’s latest developments and retention ponds were built. Those maps are helpful, but they don’t always capture the latest grading changes, new subdivisions, or shifting drainage paths.

That’s where a flood elevation certificate bridges the gap. Surveyors use modern GPS equipment and established benchmarks to measure your actual on-site elevation, not what an old map shows.

For example, your neighborhood might look perfectly level, but your backyard could slope just enough to collect runoff from your neighbor’s yard. One inch of elevation difference can make or break how water flows—or floods—across your property.

Lessons From the 2025 Storms

This fall’s record-breaking rainfall was more than an inconvenience—it was a test. Stormwater systems across Salt Lake County, including South Jordan, reached their limits. Retention ponds overflowed. Drains clogged with debris. Even brand-new homes saw water trickle into basements and crawl spaces.

Surveyors working after the storm found that many homes had grading changes over the years—landscaping projects, added patios, or re-sodded lawns that shifted the way water drains. These small alterations can quietly change your flood profile without anyone realizing it.

That’s why it’s smart to update your flood elevation certificate after a major storm. It documents your property’s true condition and helps you make informed decisions before winter rains return.

Why Lenders and Insurers Are Asking for It

If you recently refinanced, applied for a home equity loan, or updated your insurance policy, you might have been asked for a flood elevation certificate. It’s not a random request.

After widespread flooding, lenders tighten their risk rules. They want to verify that the property used as collateral isn’t at high flood risk. Insurance companies do the same because one flood claim can cost thousands.

Without a current certificate, your home might automatically fall into a “high-risk” category, even if your lot is actually higher than nearby properties. The result? You could end up paying for flood insurance you don’t really need—or more than you should.

What the Process Looks Like

Getting a flood elevation certificate isn’t complicated, but it does require precision. A licensed land surveyor will visit your property to take elevation measurements at key points:

- The lowest floor of your home (including basements)

- The lowest adjacent grade (where the ground touches the house)

- Foundation vents, decks, and garage floors

- Nearby benchmarks or survey monuments for accuracy

The surveyor then fills out the official FEMA Elevation Certificate form, signs it, and stamps it with their professional seal. This document becomes part of your permanent property record, and you can share it with your insurance agent, city, or mortgage company.

Most elevation certificates acost between $500 and $900, depending on your lot size and location. It’s a one-time investment that can save you a lot of stress—and possibly money—later.

How It Helps You Long-Term

An elevation certificate doesn’t just satisfy banks or insurance companies. It’s your proof of protection.

If your property sits higher than FEMA’s flood level, you can request a Letter of Map Amendment (LOMA) to officially remove your property from the flood zone. That means no more mandatory flood insurance.

If your home is lower, you’ll have the information you need to act—like improving drainage, adding a swale, or installing sump pumps. You can also use the data to plan grading work or foundation waterproofing that targets your home’s specific weak points.

In other words, it gives you control instead of guesswork.

Take Action Before the Next Storm

South Jordan’s storm season isn’t over. Winter rain and early snowmelt can cause just as much trouble as summer downpours. Getting a flood elevation certificate now ensures you’re not caught off guard again.

Don’t wait until a lender or insurance agent demands it. Get ahead of the issue and protect your biggest investment—your home.

If you’re unsure whether your property needs one, a quick site visit from a licensed surveyor can tell you where you stand—literally.

Final Thoughts

The October 2025 floods were a reminder that even well-planned cities like South Jordan aren’t immune to sudden weather shifts. As rainfall patterns change, flood elevation certificates have become essential tools for smart homeowners.

They don’t just satisfy paperwork requirements—they give you clarity, confidence, and control over your home’s future.

So before the next storm season arrives, get your elevation data checked. It’s a simple step that can make all the difference when the rain starts to fall.