If you were recently told you need an elevation certificate, you’re probably confused. Nothing flooded. No storm rolled through your neighborhood. Your home looks exactly the same as it did last year.

Yet suddenly, a lender, insurer, or city office is asking for paperwork you’ve never needed before.

This is happening across many growing communities, and it’s not random. The real reason sits behind the scenes: flood map updates.

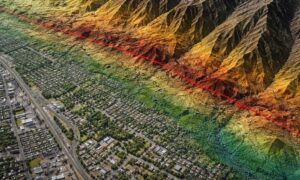

Flood Maps Can Change Even When Your Property Doesn’t

Flood maps are not static. They are updated as new data becomes available. Over time, agencies collect better elevation data, refine drainage models, and adjust how water movement is predicted.

Because of that, a property can move into a different flood category without any visible change on the ground.

In other words, your house didn’t become riskier. The data describing it did.

As these updates roll out, thousands of properties are being re-evaluated at the same time. As a result, requests for elevation certificates rise fast and all at once.

Why These Updates Are Happening More Frequently Now

Flood mapping has improved significantly in recent years. New tools allow agencies to measure land elevation more accurately than ever before. At the same time, growing cities add roads, homes, and drainage features that change how water moves across land.

Because of this, older flood maps no longer reflect current conditions.

So when new maps are released, lenders and insurers respond immediately. They rely on the latest data, even if homeowners haven’t been notified yet. That’s where the elevation certificate becomes critical.

Why Elevation Certificates Are the First Thing Requested

When flood maps change, uncertainty follows. Lenders and insurers don’t guess when risk is unclear. Instead, they ask for proof.

An elevation certificate provides that proof. It shows how a structure sits compared to updated flood levels. Without it, institutions often assume the safest position for themselves, not for the homeowner.

That default assumption can slow down approvals, stall transactions, or trigger extra requirements.

So while it may feel sudden, the request is part of a broader risk review process tied directly to new flood data.

When Property Owners Usually Get Caught Off Guard

Most elevation certificate requests don’t happen during quiet times. They appear during moments when timing matters.

For example, many homeowners learn they need one while refinancing. Others find out during a home sale, often after inspections are complete. Some receive the request while applying for a loan, permit, or line of credit.

Because flood map updates affect entire areas at once, surveyors often see clusters of requests tied to the same neighborhoods.

That’s why these requests feel widespread and urgent.

Why “Last-Minute” Requests Are So Common

Flood map updates don’t arrive with door-to-door notices. Instead, lenders and insurers adopt them internally first.

As a result, a transaction may look fine until the final review stage. At that point, the updated map flags the property, and the elevation certificate becomes a condition to move forward.

This timing creates stress for buyers and sellers alike. However, understanding the reason behind the request helps remove some of the frustration.

Why Older Elevation Records Often Don’t Work

Some homeowners try to use older elevation documents to resolve the issue. Unfortunately, that rarely succeeds.

Flood map updates often rely on new reference systems or adjusted benchmarks. Because of that, older elevation data may not match the current standards being used.

Even if the structure hasn’t changed, the way elevation is measured and evaluated may have.

That’s why lenders usually require a current elevation certificate that aligns with the updated flood map.

Why These Requests Are Increasing in Growing Areas

Communities experiencing new development tend to see more flood map revisions. New construction changes runoff patterns, grading, and drainage flow.

As neighborhoods expand, flood models must be updated to reflect those changes.

Therefore, areas with active growth often experience more elevation certificate requests than stable, long-established neighborhoods.

This trend is likely to continue as development and mapping technology advance together.

How an Elevation Certificate Helps Resolve the Issue

An elevation certificate doesn’t create new risk. Instead, it clarifies real conditions.

It confirms how a building sits relative to the updated flood map. In many cases, it shows that the structure is higher than the flood level used in the new classification.

That clarity allows lenders and insurers to move forward with confidence. Without it, decisions are made based on assumptions.

So while the request may feel inconvenient, the document often becomes the fastest way to remove uncertainty.

Why Acting Early Makes a Difference

Once a flood map update affects an area, survey demand rises quickly. That can lead to scheduling delays if everyone waits until the last moment.

Homeowners who act early avoid those bottlenecks. They also reduce the risk of delayed closings or stalled approvals.

Even if you’re not in a transaction today, knowing whether your property is affected puts you in control instead of reacting under pressure later.

Why Local Experience Matters More Now

Flood map updates don’t affect every street the same way. Small elevation changes can make a big difference.

Local survey professionals understand how new flood data applies at the neighborhood level. They also know how lenders and agencies interpret those updates in practice.

That local insight helps prevent rework, delays, and unnecessary follow-ups.

Flood Maps Will Keep Changing—And That’s the New Normal

Flood map updates are not a one-time event. As data improves and cities grow, revisions will continue.

Because of that, elevation certificates are becoming a regular part of property verification, not an exception.

Understanding why these requests happen helps homeowners stay calm, prepared, and informed.

If you’re asked for an elevation certificate, it doesn’t mean something went wrong. It usually means the data changed—and your property needs to be verified under the new rules.

Staying ahead of that process keeps your plans moving forward without surprises.